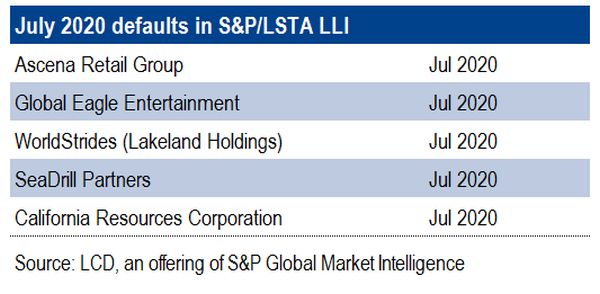

Loan defaults in the United States continued to rise in July, surpassing 4% by number of issuers for the first time since 2010, after five components of the S & P / LSTA Loan Index. leverage tripped the defaults of $ 7.7 billion term loans.

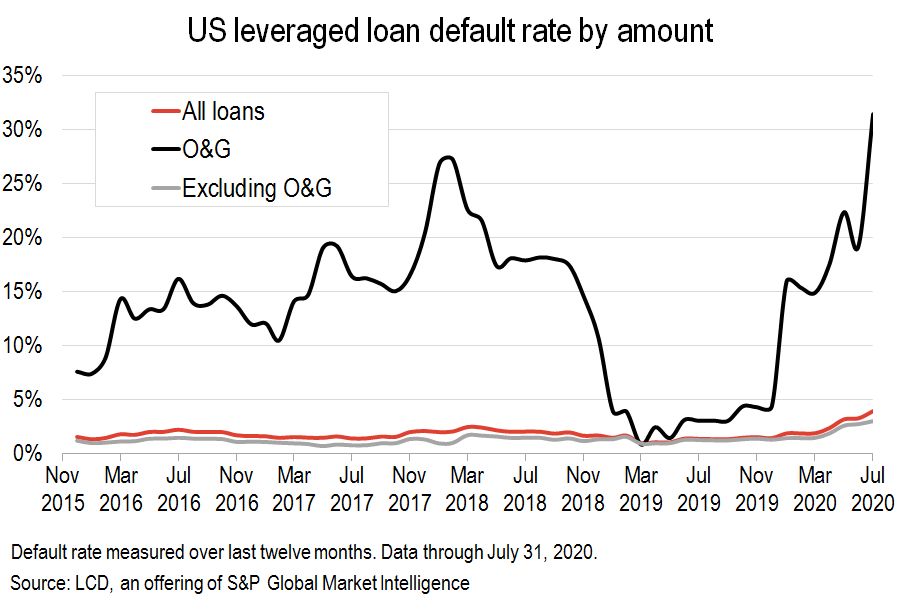

The rate by number of issuers, at 4.14%, is the highest since September 2010. By amount, defaults, at 3.90%, have been at a high level since February 2015. Excluding defaults of 19.5 billion dollars from Energy Future Holdings Corp. in April 2014, the rate per amount was the highest since June 2010.

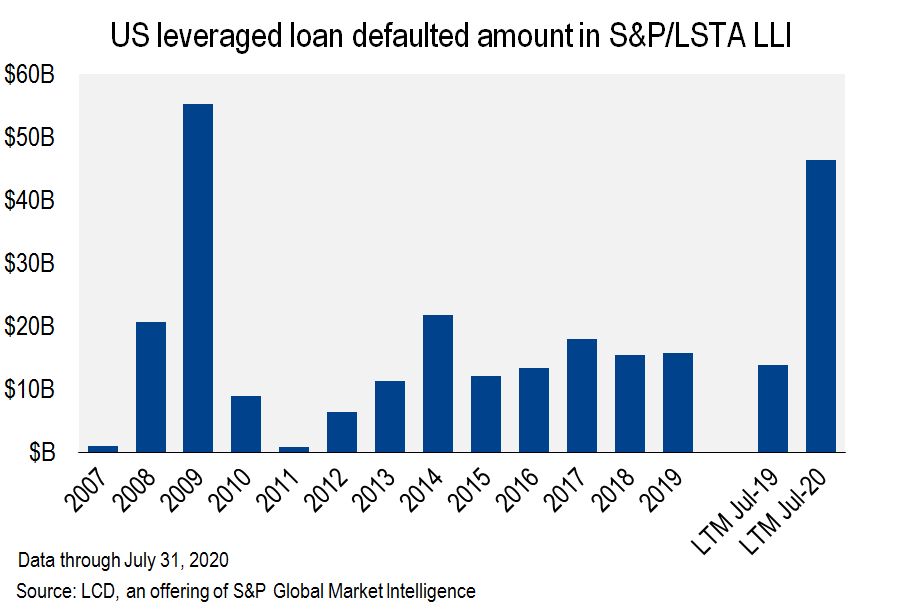

With the economic fallout from the coronavirus pandemic playing a growing role, the volume of defaults over the past 12 months, at $ 46.35 billion, is 233% higher than the same period of 2019.

Access our free webinar on troubled energy debt

Access now

That being said, for July’s volume, only educational travel provider WorldStrides Inc. had achieved a B rating prior to the COVID-19 outbreak, joining companies such as Hertz Global Holdings Inc., Cirque Du Soleil America Inc. , 24 Hour Fitness, Fieldwood Energy, Technicolor, CEC Entertainment Inc. (Chuck E Cheese) and Covia Holdings Corp. (Fairmount Santrol), to see such a rapid drop in that rating bracket. All other defaults in July (California Resources, Seadrill Partners LLC, Global Eagle Entertainment and Ascena Retail Holdings Inc.), were rated CCC at the end of 2019.

|

After Retail broke a sector default record in May, the Oil & Gas sector did so in July. At 31%, it once again massively exceeds the broader landscape of defaults.

|

In the past, many players in the energy sector have attempted to resize their capital structure in order to overcome what has become a historic and sustainable environment of low oil prices, and then return to the restructuring table. And loan issuers are no exception.

Californian Resources in July filed for chapter 11 after completing a vast top exchange in 2015. Fieldwood Energy defaulted in May do not make payments on his first and second lien term loan, just one year after leaving bankruptcy. Ultra Petroleum Corp. in may filed for bankruptcy after to finish a struggling exchange in 2018, having emerged about a year earlier from bankruptcy.

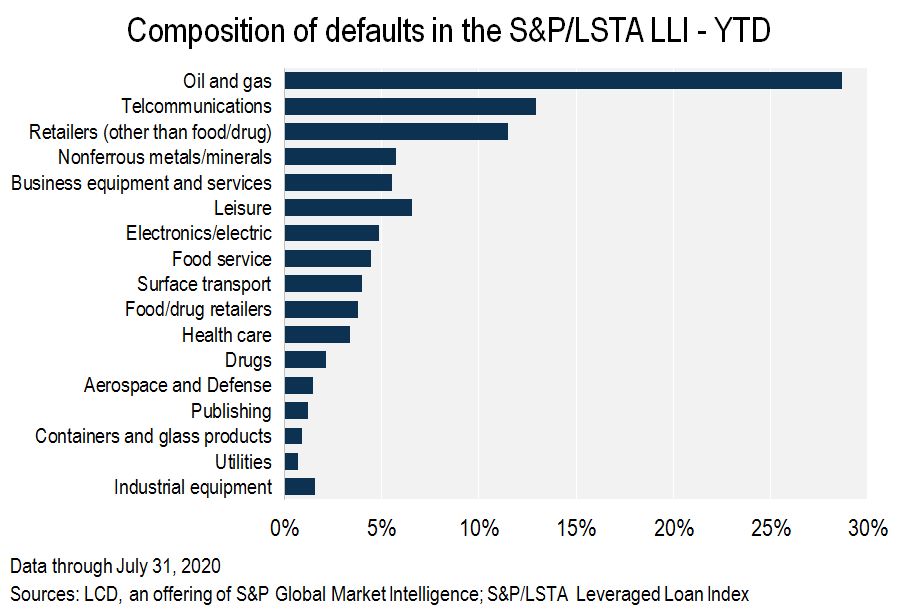

Across all sectors, since the start of the year, oil and gas have contributed more than a quarter of all defaults this year, at 29%. Telecommunications follow at 13%, as does retail at 12%.

|

The weakest link

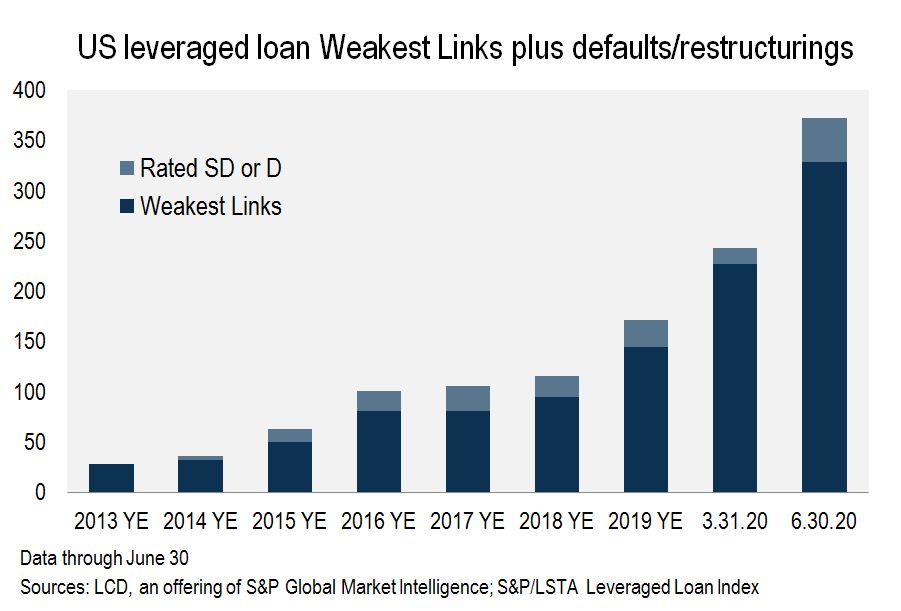

Forward-looking indicators, unsurprisingly, continue to point to an increase in default activity in the wake of the pandemic and the widespread shutdown of economic activity.

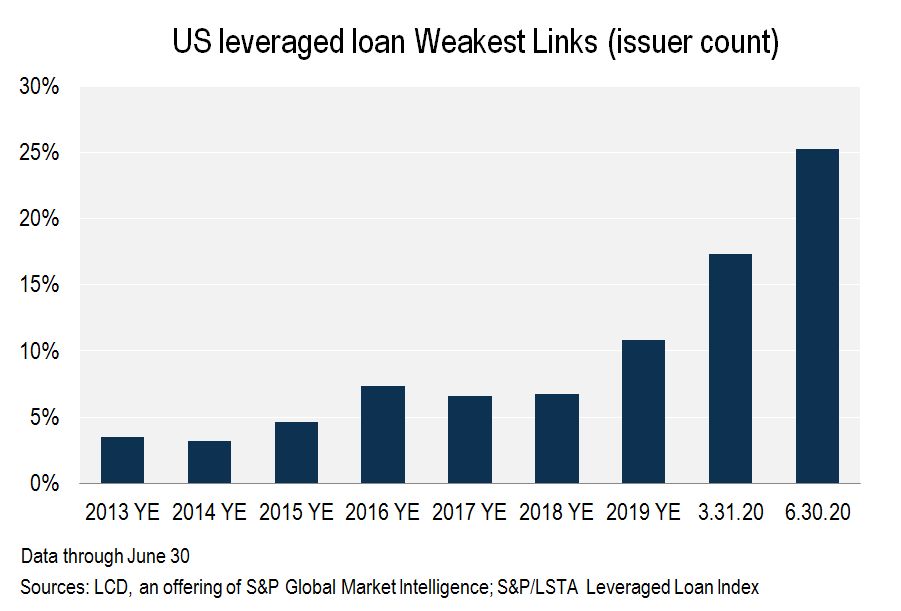

In the first “Weakest Links” quarterly view monitoring loan since the COVID-19 pandemic took hold, LCD analysis showed that the number of weakest links had increased to 329 transmitters, against 227 in March and 145 in December.

|

The weakest bonds of LCD loans, loans less than 24 hours in the LCD universe that have a corporate credit rating of B– or less and a negative outlook of S&P Global Ratings, per share, have thus increased to 25%. at the end of June, compared to 17% at the end of March and 11% at the end of 2019.

|

This comes, of course, as downgrades continue to overtake upgrades at a breakneck pace. As of July, 37% of the loan market by nominal amount outstanding at the facility had been rated downgraded this year, representing $ 435.1 billion of the $ 1,169 billion in rated loans at the end of the year. 2019.

Downgrades to upgrades have declined since the peak in May, but they remain high. In July, 33 loans were downgraded, against 7 upgraded. On a rolling three-month basis, the loan degradation / reclassification ratio, at 8x, is down from the record of 43x in May, but still above 3x at the end of 2019.

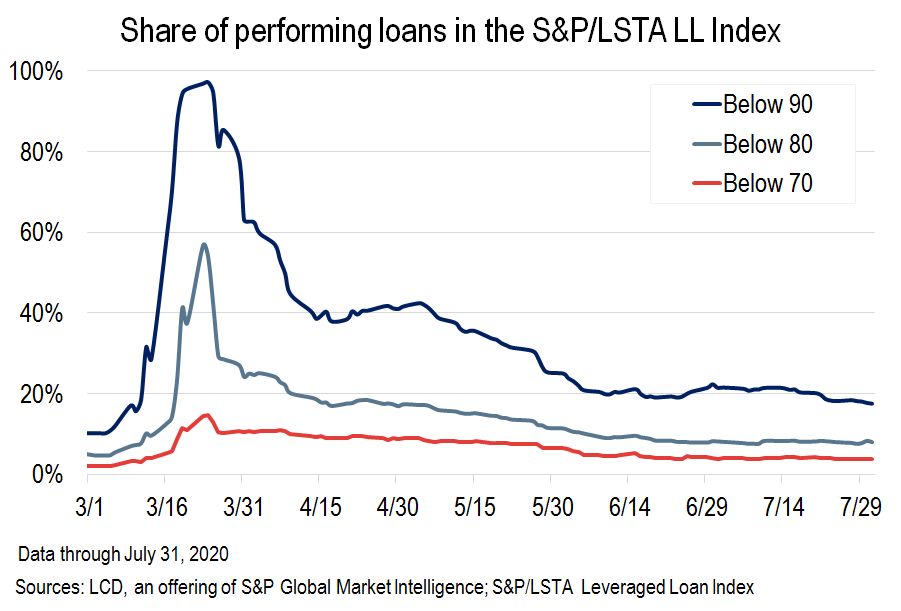

In terms of market distress, levels have also come a long way from the distress peak of 57% on March 23.

After an average of nearly 20% in April and 15% in May, only 8% of healthy outstandings were listed below 80 at the end of July. This compares to 4% at the end of 2019.

|

|

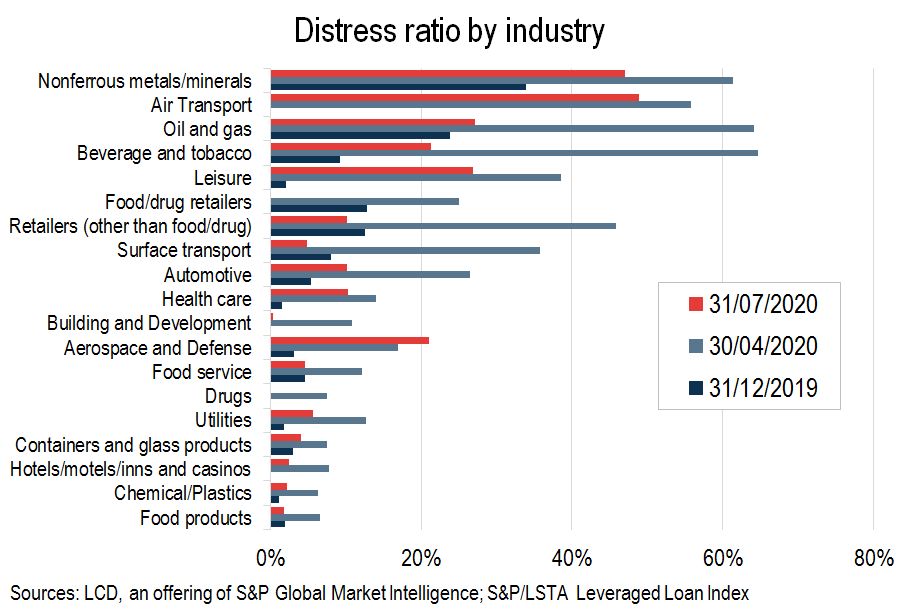

Among the sectors with a more significant index share (above 1%), oil and gas and leisure continue to lead the distress at the sector level. Oil and gas, the mainstay of the compartments in difficulty, has a distress rate at the sector level of 27.1%, against 23.8% at the end of 2019. Leisure, on the other hand, held only 2.1% of the loans of the sector at a lower price. 80 at the end of 2019. Unsurprisingly, given the lockdown measures and travel restrictions, the distress ratio at the sector level is now among the highest for industries with an index share of 1% or more, at 26.9%.

|

This article was written by Rachelle Kakouris, Research Director at LCD.

Sign up for LCD newsletter to receive more stories about leveraged loan defaults

Follow LCD on Twitter.

LCD comps is an offer of S&P Global Market Intelligence. LCD’s subscription site offers comprehensive information, analysis and data covering the global leveraged loan and high yield bond markets. You can know more about the LCD screen here.

No Comment